Judy was a busy entrepreneur, focused on achieving success in her business and creating a large Free Market retirement plan so she could eventually retire and be financially independent. Her goal was to retire in fifteen years. Trouble was brewing, however ...

Judy was a workaholic who only thought about her business. She had plenty of income, but repeatedly neglected to pay her mortgage on time and “forgot” to make credit card payments, due to her tunnel vision regarding her business. Fortunately, her retirement investments were automatically invested electronically each month and on target.

Judy needed more balance in her life. Crying, she called us for advice, as someone from her mortgage company told her she had to make her mortgage payment within forty-eight hours or they would proceed with legal action. Judy said she could not break away from work, as she had commitments.

We advised Judy to immediately put her personal needs first, and take the next day off to get her debts paid up and to set up a plan to simplify her life. She reluctantly followed our advice—and found balance in her life! She set up automatic payments for her future mortgage payments, and learned how to pay her credit card bills online. Judy quickly made her life more efficient and got her finances under control.

You, too, could simplify your life! Consolidate your affairs, because complexity creates frustration and confusion, and zaps your energy! Clean up the messes in your life: Keep your finances, investments, and home simplified and organized.

Ideas for getting started:

- Organize and label your old photos, so your heirs will know who is who.

- Give adult children their “growing-up” photos and items they’ve stored at your home.

- Give away, sell, or toss items that you have not used or needed for two years.

- Give heirlooms to your heirs, while you are of sound mind.

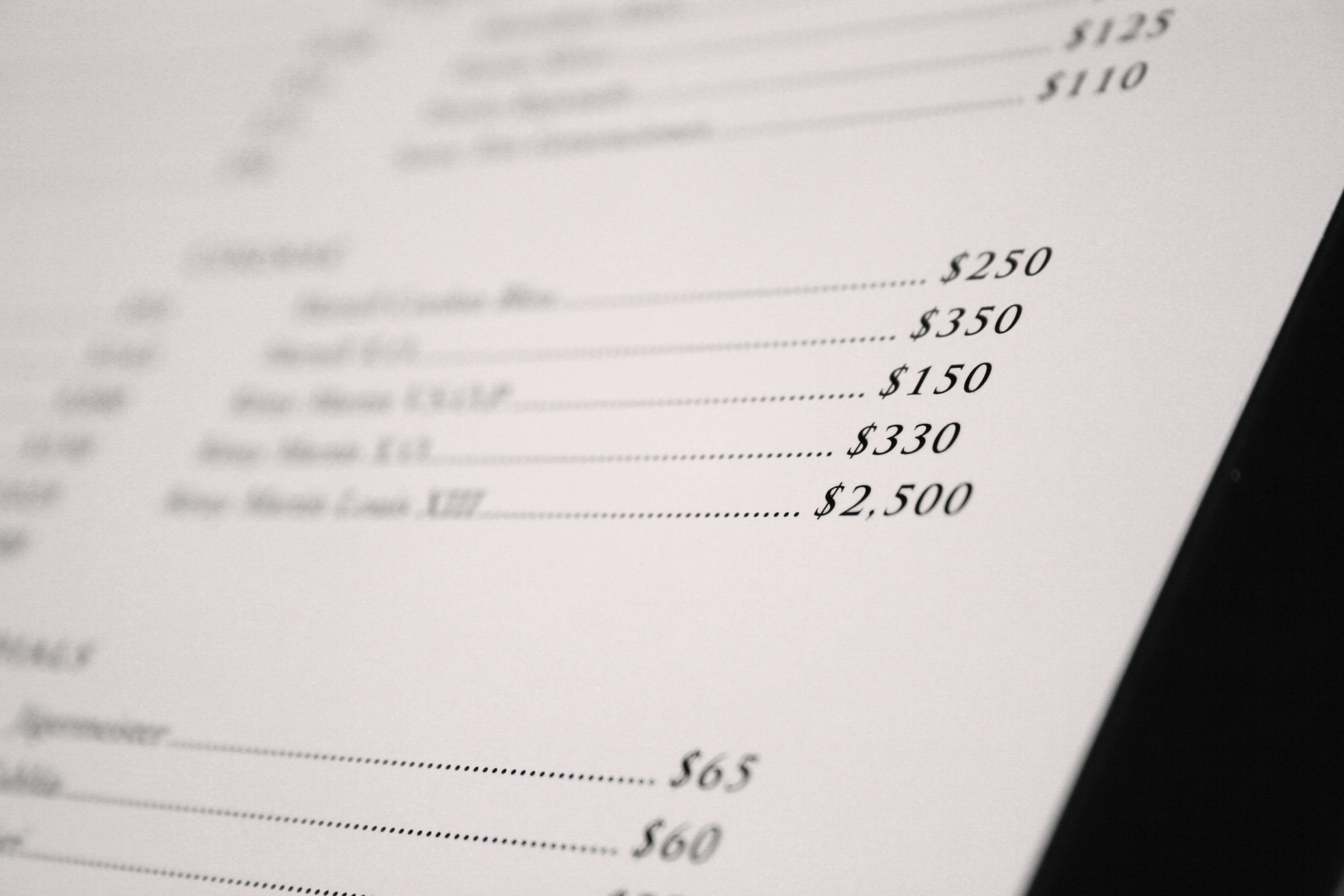

- Make a record of your valuables, investments, insurances, and legal documents.

- Set up your tithing, bills, and credit cards to be paid automatically.

- Understand your investments and set up monthly automatic contributions.

You are helping your heirs by taking control, investing systematically, organizing your home, and giving your heirs part of their inheritance now. They will love you for it! Plus, you will able to see how they will eventually handle their future inheritances.

Deal with complexities now, so your heirs don’t have to deal with them later. If you need professional help, get it!

Live by the KISS rule.

Written by: Maria J. Wordhouse Kuitula and Phyllis J. Veltman Wordhouse, Free Market Wealth & Stewardship Coaches, co-authored the book Stress-Free Investing, available at Amazon.com. Maria, the president of Wordhouse Wealth Coaching, may be reached at 616-460-6518 or at [email protected]. For QUESTION LISTS and INVESTOR EDUCATION VIDEOS, go to www.WordhouseWealthCoaching.com. © Wordhouse Kuitula 2013 Photo: stock.xchng