Who will pay for your retirement? Statistics show that you must plan on providing for seventy-five percent of your retirement income from your savings or investments. Be a smart investor; don’t plan on receiving any government help! Plan to cover one hundred percent of your retirement expenses.

Would it be easier to retire if you were a millionaire? How about a multimillionaire? Anyone can become wealthy. However, the younger you are, the easier it is! Starting young is very important. We encourage you to help your youngest relatives and friends to become aware and successful investors.

Have no idea how much you will need at retirement? Let’s look at what kind of income you can count on with the amount that you anticipate having when you retire. With a $500,000 nest egg you can expect to have $25,000, or a five percent income per year. If you saved $1 million, expect a retirement income of $50,000 per year. Next, figure in annual cost of living increases, also called inflation. Expect the cost of living to go up three percent every year, as long as you live! Does this help you see the big picture?

If you are fortunate to have a long time horizon before you retire, investing immediately for your future retirement gives you time to include more risk to your investments. You need a domestic and international growth investment strategy that earns an average eleven percent annual return. The easiest way to save is automatically every payday, or once a month. When is the best time to start? Immediately!

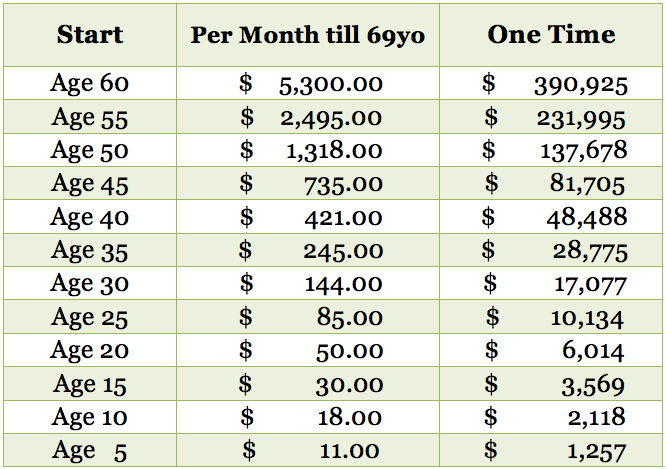

The table to the right shows you how much you may need to invest monthly or in a one-time lump sum in a globally diversified portfolio averaging an eleven percent return according to your age, to potentially have $1,000,000 when you reach age sixty-nine, which may soon be the new retirement age. Past performance is no guarantee of future results.

Why save now, when you need all of your money? That’s the wrong attitude. The best way to save is to have the money withdrawn from your bank account before paying your bills. Also, commit every pay raise you receive to your growth retirement investments.

We feel the best place to place your retirement savings is in a tax-free globally diversified portfolio. If you have an employer plan at work with a match, do whatever it takes to qualify for the free money. Also do a Roth IRA if you qualify. Your young children could also have a Roth if they earn money and keep records of their earnings. Otherwise, place the money into a free market growth account, for minimal annual taxes. And remember, always pay yourself first!

Written by: Maria J. Wordhouse Kuitula and Phyllis J. Veltman Wordhouse, free market wealth and stewardship coaches, co-authored the book Stress-Free Investing, available at Amazon.com. Maria is the president of Wordhouse Wealth Coaching and may be reached at 616-460-6518 or [email protected]. For QUESTION LISTS and INVESTOR EDUCATION VIDEOS, go to www.WordhouseWealthCoaching.com. © Wordhouse Kuitula 2013. Photos: stockxchng