Branching out allows your retirement savings to weather different seasons

There are many factors to consider when it comes to planning for a secure and fulfilling retirement—from how you'll fill your time to where you'll live and how you'll pay for it all. One solution is diversifying your retirement income.

Similar to asset allocation among your investments, this approach advocates establishing independent streams of income that could provide needed cash flow under a variety of circumstances. The big idea is to put your eggs in several baskets since none of us know what the markets will do over 20 to 30 years of retirement, much less how long we'll need our money to last.

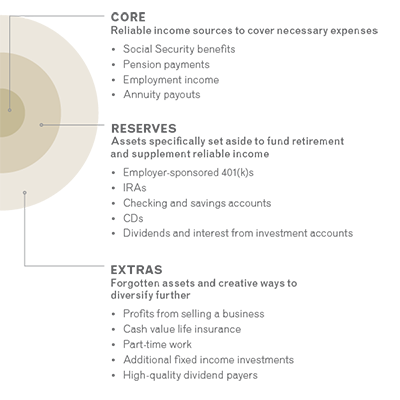

Start with the core sources

What streams of reliable retirement income will serve as your main source of cash flow? Keep in mind that essential retirement needs and expenses will be different for every retiree and can include mortgage payments, groceries, utilities, insurance, transportation and healthcare.

Graft on the reserves

If your needs aren't quite covered by your main sources of income, you may have to turn to other income to fill the gaps. If your needs are covered, you can use the extra bounty to pay for the good stuff – the wants and wishes that reflect your personal vision of an ideal retirement.

Then branch out

After you start making withdrawals, you may wonder if you have enough planned retirement income to cover both your needs and wants. We can help you uncover forgotten assets, such as an old 401(k) or inheritance.

We stand ready to help you determine how more reliable income sources will perform in "normal" markets, recessions or periods of high inflation. By analyzing each source, we can help you gain confidence in the ability of each to withstand a long haul. If you're not sure you'll have enough, let's look at all the pieces that make up your net worth for a plan to help get you closer to your retirement goals and help ensure we're optimizing the most tax-efficient way to draw from your accounts.

The key elements for a long, and hopefully prosperous, retirement—reliable income, retirement assets, needs and wants—work together to create a clearer understanding of your financial picture and the income sources that will be used to cover retirement expenses. Let's talk about how to best structure your assets in a way that manages risks, diversifies your investments as well as your income, and seeks to provide a reliable retirement paycheck. One that has a greater chance of lasting as long as your retirement will.

Contributed by Melissa Stewart, CFP®, Financial Advisor at Blueway Financial Partners of Raymond James & Associates.

Investing involves risk including the possible loss of principal. Past performance may not be indicative of future results. Asset allocation and diversification do not guarantee a profit nor protect against loss. Dividends are not guaranteed and may fluctuate.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, Certified Financial Planner™ and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board's initial and ongoing certification requirements.

Asset allocation does not guarantee a profit nor protect against loss.

Chart courtesy of Blueway Financial Partners of Raymond James & Associates.